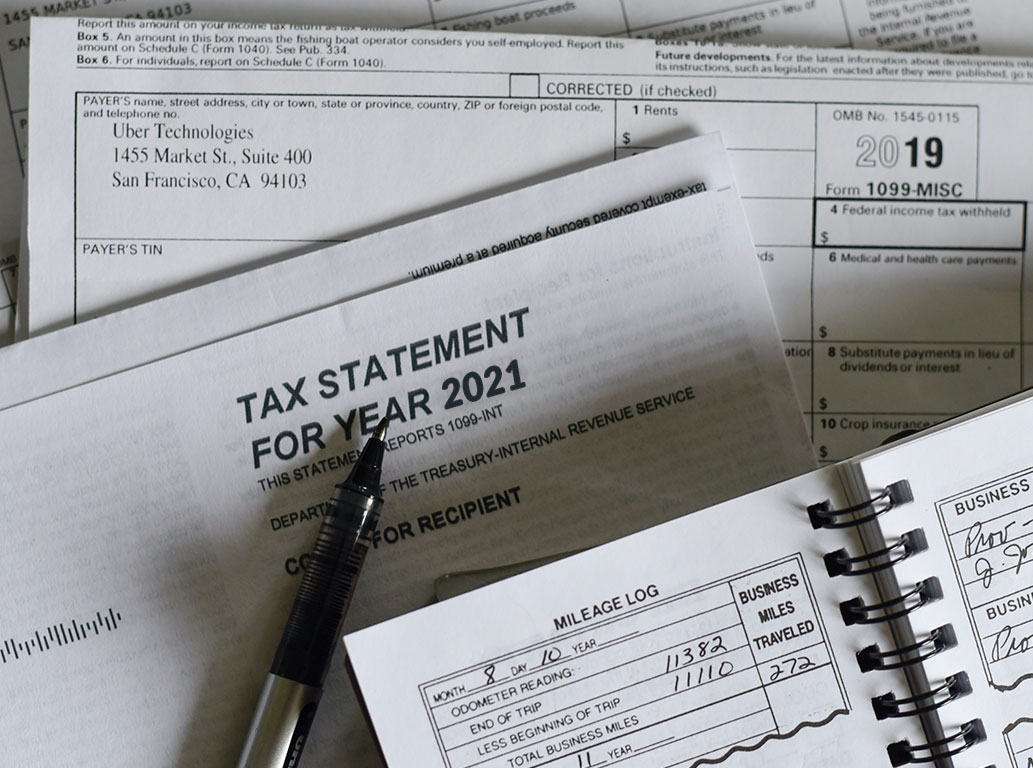

Tax Preparation

In addition to general income (wages and interest), Eric handles other tax issues including but not limited to small business income, rentals, sale of real property, parents of minors who are separated or divorced, decedents, virtual currency, out of state income, Philadelphia income tax, and moving (within the same state or out of state).

When paying for tax preparation, the perfect scenario consists of 2 things – (1) you are happy with the results of the returns and (2) you don’t receive a letter from a tax authority about the returns in the future.

Since both parties want a smooth process, it is essential that you supply all pertinent information. This includes all tax documents as well as information on whether you have any outstanding balances owed to tax authorities or not. Doing so will enable Eric to provide you with the best advice on how to move forward.

Eric also prepares tax returns for people whose primary residence is outside of Pennsylvania. If you’re not local, don’t let that stop you from contacting him! There is an additional, small fee if your primary residence is outside of Pennsylvania, but there are good reasons why his out-of-state clients return to him for tax preparation.

Business Tax Returns

A small percentage of the tax returns Eric completes are business tax returns. These include Estate and Trusts (Form 1041), Partnerships (Form 1065), and Corporation returns (Form 1120). If preparing both business and individual tax returns, you qualify for the multi-return discount. Prices for business tax returns are higher than individuals. Please call for an estimated starting price.